Current Market Trends

2

March 2022 – Statistics

SEDONA – VILLAGE OF OAK CREEK

MARKET TRENDS MARCH 2022

Welcome to Sedona Realty’s Market Statistics, where each month, I take the pulse of the real estate market in Sedona and the Village of Oak Creek.

All data is sourced from the Sedona Verde Valley Association of Realtors® Multiple Listing Service.

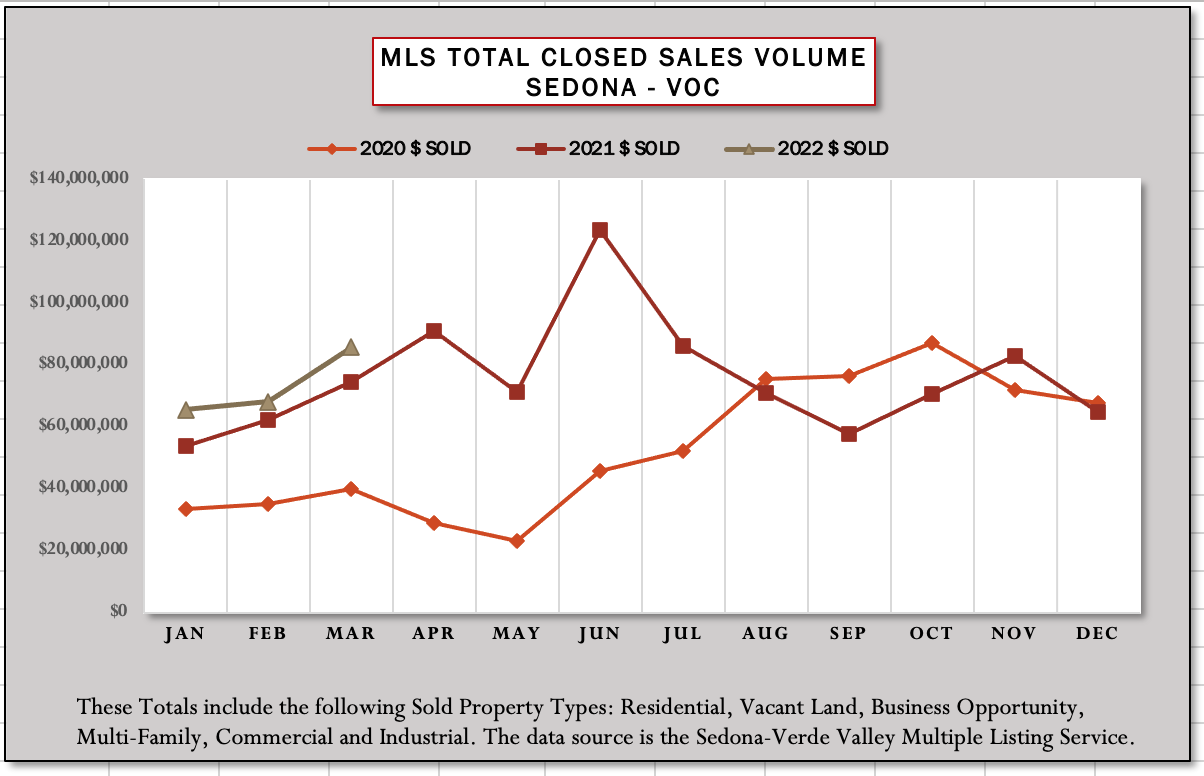

TOTAL CLOSED SALES VOLUME When a property is SOLD, it is considered to have “Closed.” Closed Sales Volume is the dollar total of all property sales recorded through the Sedona Verde Valley MLS for the month and includes Residential, Vacant Land, Business Opportunity, Multi-Family, Commercial and Industrial sales.

The 2022 March Total Closed Sales Volume of $88.9M is 30% greater than the prior month’s volume ($68.2M), and 19% higher than March 2021 ($74.6M). It is the highest March Closed Sales Volume of the last 20 years.

The Year-to-Date Closed Sales Volume sits at $219.4M, 15% over the prior year, and the highest March YTD in the last 20 years. Total closed sales volume is the total of all residential, vacant land, multi-family, business opportunity, commercial and industrial sales.

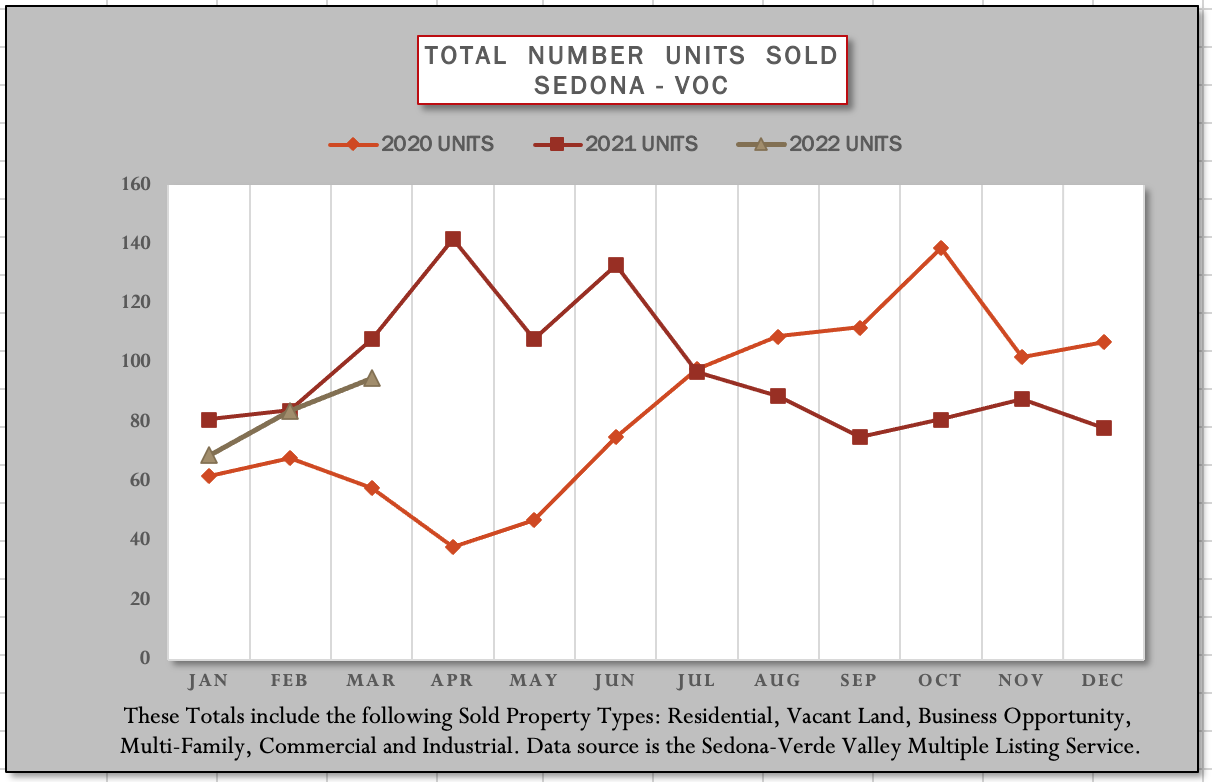

TOTAL NUMBER UNITS SOLD Each sale is considered a unit. Through the local MLS, we track how many properties have sold.

Sedona – Village of Oak Creek

In the month of March 2022, 98 properties sold thru the Sedona-Verde Valley MLS, up 17% from 84 units the prior month, but down from 108 units the prior March.

Looking only at Residential Sales – condos, townhomes, manufactured homes and single-family residential homes – 70 units closed in March, 30% higher than the prior month’s 54 closed residential sales. The total closed residential sales volume for March 2022 is $78.8M.

To continue with a traditional statistic, I note that 75 residential properties have sold for more than $1 Million through March. “One Million Dollars” is an arbitrary threshold to designate upper end home sales, which has been as a threshold used for years. However, for 2022, we begin to use $1.5 Million as a luxury threshold. Twenty-nine homes sold over $1.5M through March 2022.

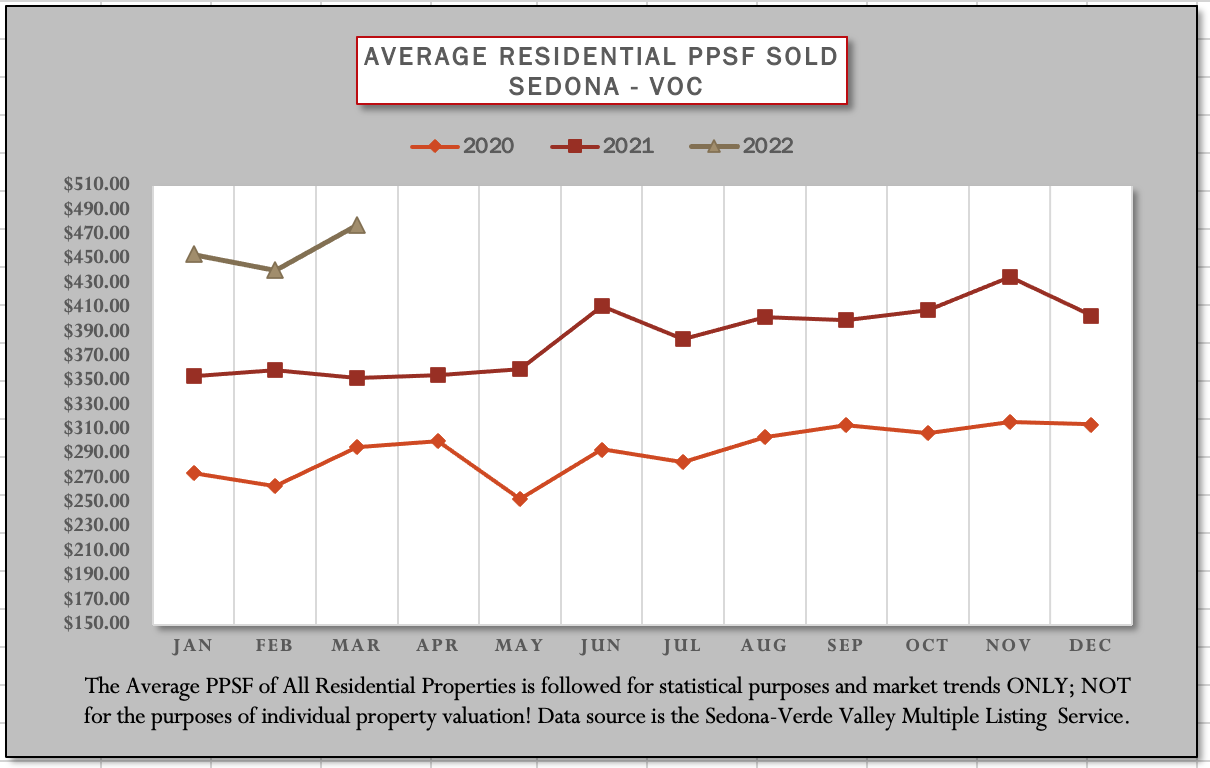

AVERAGE RESIDENTIAL SOLD PRICE PER SQUARE FOOT Since 2003, I have averaged the sold Price Per Square Foot, or PPSF, of all Condos, Townhouses, Manufactured Homes and Single-Family Residences on a monthly basis. When compared against itself, this number shows how our home values are changing, and tells us about our market. When numbers are steady, it indicates a stable market. The market continues its steady, measured increase in values experienced over the last two years.

In March of 2022, the Average Residential Price Per Square Foot, PPSF, for Sedona – VOC was $477.74, up from last month’s $442.80/SF by almost 8%. In 2021 at the end of the first quarter, the average PPSF for sold residential properties was $352.36, indicating a year over year increase of 35.5%. (Two years ago, the PPSF was $296.05. We stand 61% higher than two years ago.) The SP/LP ratio in March was 103%. The average cumulative days on market (how long it took the property to sell) in March was 61 days. Very low! Still an incredibly strong Sellers’ Market.

I’ve started breaking out the different Single-Family Residential Property Types:

In March, 56 Single Family Residential (SFR) properties closed (verses 33 in February) for a volume of $72.2M (verses $40.5M), at an average SP/LP of 104% (verses 103%), with an average PPSF of $516.96 (verses last month’s $492.64) up 5%.

In March 2022, 8 Condo/Townhomes sold for a volume of $4.4M, at a SP/LP of 100%, with an average PPSF of $373.89 (verses $398.35 the prior month) in 69 days (verses 120 days the prior month).

In March 2022, 6 Mobile, Manufactured and Modular properties sold for $2.2M, at a SP/LP 99%, with an average PPSF of $269.78 (verses $296.71 the prior month) and 45 DOM (verses 59 DOM the prior month).

The ability of a property to be a Short-Term Rental (STR) continues to be a strong driver of our market. For Single Family Residential properties, I broke out the Short-Term Rental properties (STR) from the Non-STR properties.

In March 2022, there were 30 STR properties sold (11 under $1M), with a Sales Price to List Price (SP/LP) of 106%, Average PPSF of STR properties was $538.25 (verses $536.36 the prior month) and 37 Days on Market (verses 49 DOM the prior month).

In March 2022, 26 Non-STR properties sold (9 under $1M – all but 1 in VOCA [Village of Oakcreek Association]) at an average SP/LP of 102%, an average PPSF of $488.15 (verses $451.50 last month) and 85 DOM (verses 69 DOM the prior month).

Using the average PPSF of STR and Non-STR properties to compare values, in March 2022, STR properties sold at 10% greater value than non-STR’s (verses 18.8% greater the prior month).

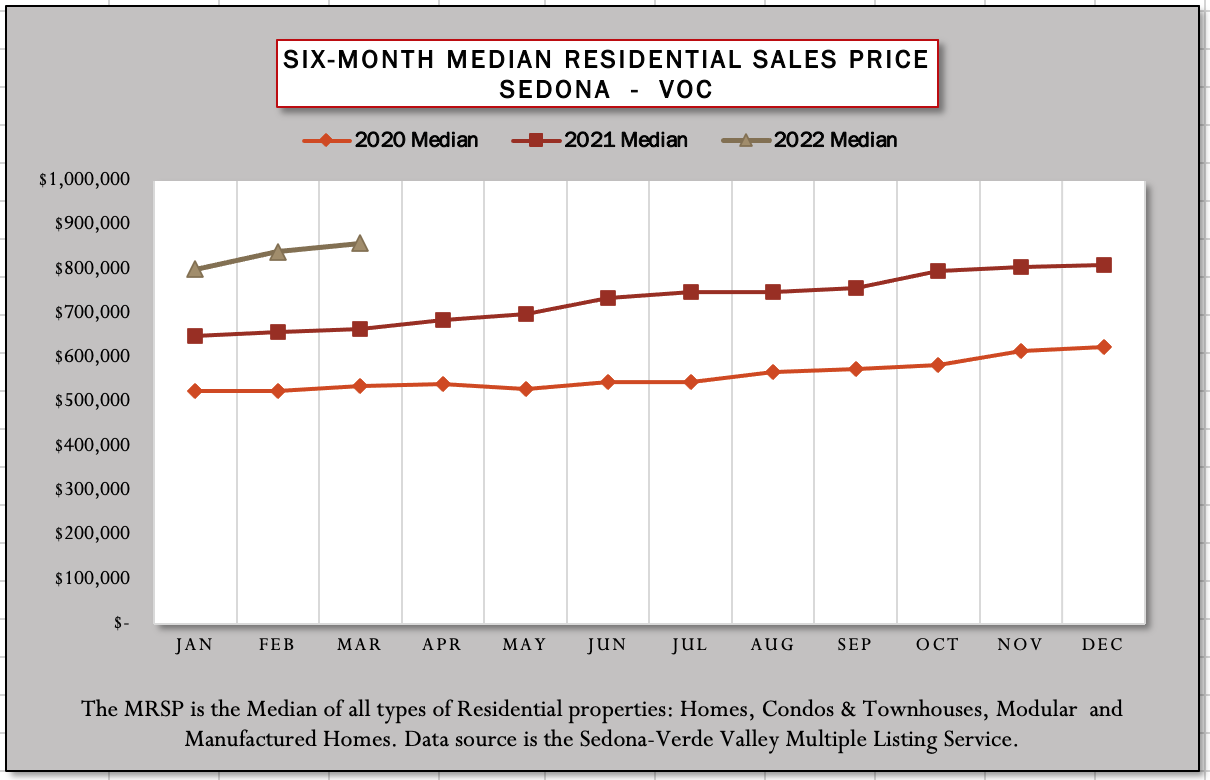

SIX MONTH MEDIAN RESIDENTIAL SALES PRICE During the darkest days of the Great Recession, I began to track the median sales price of all residential properties sold in the six months up to and including the subject month for an added, long-term perspective on sales price trends.

This month of March 2022, the six-month median for Sedona – VOC market area continued to climb from $840,000 the prior month to the current $859,450.

VACANT LAND CLOSED SALES – There were 26 vacant land parcels that closed in March (verses 24 in February) for the total VL closed sales volume of $9.1M. All the sales were for residential lots, ranging between $70,000 to $1,200,000.

COMMERCIAL / INDUSTRIAL / MULTI-FAMILY CLOSED SALES VOLUME in March 2022 was $945,050 for two sales – a Multi-Family property in West Sedona and a Commercial condo in the Village.

With inventory at about 15% of what had traditionally been available for purchase over the last 20 years and strong, strong Buyer demand, all indications are for a continued strong market in the Sedona – Village of Oak Creek area through the end of this year and into 2023.

Thank you!

Claudine Pinto

AZClaudine@gmail.com

This Tradename, Sedona Realty®, and the SedonaRealty.com website are for sale. Contact Claudine Pinto at AZClaudine@gmail.com.

Your Source for Sedona Real Estate

Claudine Pinto

REALTOR®, Associate Broker, ABR, CRS, ePro®